how to calculate sales introduction to finance

The following entry explains a basic principle of finance the so-called efficient frontier and thus serves as a gentle introduction into one area of finance. All code that is.

An Introduction To Financial Accounting Wangziaidao Xmind The Most Professional Mind Map Software Financial Accounting Accounting Accounting And Finance

In reality many of the given variables in this chapter would come from other budgets.

. Take-or-pay and throughput contracts 6. In cost volume profit analysis the following formula is used. To keep things simple we will calculate these expenses as variable expenses in the same way as we calculated Sales using 1growth rateprior years cost.

You can then type that calculation into a new cell C5 by using the following formula. You can use it to forecast sales and determine which opportunities are worth the most. Guaranteeing the debt of affiliates In addition historical financial data has limitations since the subject firm can.

Sales represents the total units you sold multiplied by the sale price per unit. Use of finance affiliates 3. C1 - C2C3C4 Net sales 200000 - 140 20000 200 or 200000 - 20340 or 179660 Example of net sales formula in use.

But for our sake lets just say that when you give the widget you have earned the money that they give you and thats revenue sales. Forecasting Depreciation and Amortization. Sales Revenue Units Sold x Sales Price.

Current months performance - previous months performance100. This KPI dissects the effectiveness of your sales process by telling you about the opportunities that your sales reps are creating. Sales Equations P R - C M P C G P R If you know at least 2 values and 1 value is a dollar value you can calculate the other 3 after some algebraic manipulation of the three equations.

Review the net sales formula. Gross P rofit R evenue - C ost. To do this take your gross sales C1 and subtract the sum of your deductions C2 C3 and C4.

The formula for net sales is Gross sales less Sales returns. Operating Income Price x Units Sold - Variable Cost Per Unit X Number of Units Sold - Total Fixed Costs Gross Margin vs Contribution Margin. Record revenue too soon 3.

Forecasted Sales Current Sales x 1 Growth Rate100 If Mr. The sales revenue calculation is very simple. Tabulate materialcomponent flow labor energy.

When a person or a company discovers a potential deal and brings to any parties that may be interested they would receive a finders fee for their involvement in the interaction. Break-even Point Sales in dollars Fixed Costs Sales Price per Unit x BEP in Units. This is simply Gross profit less SGA.

We are simplifying things somewhat. For example a firm would usually have at least a sales budget from which the sales forecasts are taken a salary budget a capital expenditure budget. So lets say the revenue or the sales in this case in a given period lets say that this is an income statement for 2008.

Calculate total revenue minus total expenses Which of the following would explain a companys day sales outstanding ratios rising from 32 to 4125. Determine resources and required for at-scale productionoperation. The return on assets ratio Return on Assets ROA Formula ROA Formula.

To understand a companys financial position you need to review and analyze several financial statements. Use of joint ventures 7. How to calculate it.

Compares the operating income of a company to its net sales to determine operating efficiency. Calculation of the ending cash balance and short-term borrowing needs. Cash flow dynamics of ramping production and varying sales investments timing Similar information for other projects competing for resources decision-making.

Production Operation Cost Model. For example say a company sold 1200 lamps priced at 15 each variable costs were 5 per unit and fixed costs for the company are 2000. The companys accounts receivable has remained constant while total sales has decreased.

Variable Costs are the costs that are dependent on the volume of sales such as the materials needed for production or manufacturing. Portfolio theory using R. Calculating EBITDA Earnings Before Interest Tax Depreciation and Amortization.

Your customer service team will also have insights into the potential of a new product. Operating margin ratio Operating income Net sales. For example if a company has gross sales of 100000 sales returns of 5000 sales allowances of 3000 and discounts of 2000 the net sales are calculated like this.

Discuss your project with them and get their help in estimating how many units you can move in the initial months as well as what the ramp up rate might be. Record questionable revenue 2. Full Business Financial Model.

As the user wants to perform calculations like multiplication summation subtraction by 4 and find out the square root of all numbers in MS Excel. It is calculated by dividing the operating profit by total revenue and expressing as a percentage. Sales representatives know your market intimately including what your competitors are doing.

Later on well talk about different ways to account revenue and sales. Use of securitization 5. Balance sheets income statements cash flow statements and annual reports.

It is the number of a product sold multiplied by the sales amount of that item. This calculator will calculate any three of the sales values based on any 2 inputs that you provide. Profit px - vx - FC Where p equals price per unit x is the number of units sold v is variable cost and FC is fixed cost.

Weaver assumes that sales will increase by 30 next year then when. Fixed Costs are the costs that are independent of the volume of sales such as rent. A second part will then concentrate on the Capital-Asset-Pricing-Method CAPM and its assumptions implications and drawbacks.

Thats the financial break-even. Here we are going to learn how to use Excel to calculate basic calculations like summation average and. Summary of Example 1.

Another name for a business introduction fee is a finders fee which is a commission that a business pays to the person who facilitated the introduction. Example 2 Basic Calculations like Summation Average and Counting. Operating Income Sales - Total Variable Costs - Total Fixed Costs In order to better your understanding this basic equation can be expanded.

100000 Gross Sales - 5000 Sales Returns - 3000 Sales Allowances - 2000 Discounts 90000 Net Sales. Sales or factoring of receivables 4.

Introduction To Inventory And Cost Of Goods Sold Cost Of Goods Sold Cpa Exam Inventory

Gross Profit Percentage Meaning Example Advantages And More Learn Accounting Economics Lessons Accounting And Finance

Overview Of Asset Backed Securities Abs Finance Train Security Finance Asset

The Financial Management Cycle Financial Management Accounting Basics Accounting

The Black Scholes Formula Explained Finance Tracker Implied Volatility Partial Differential Equation

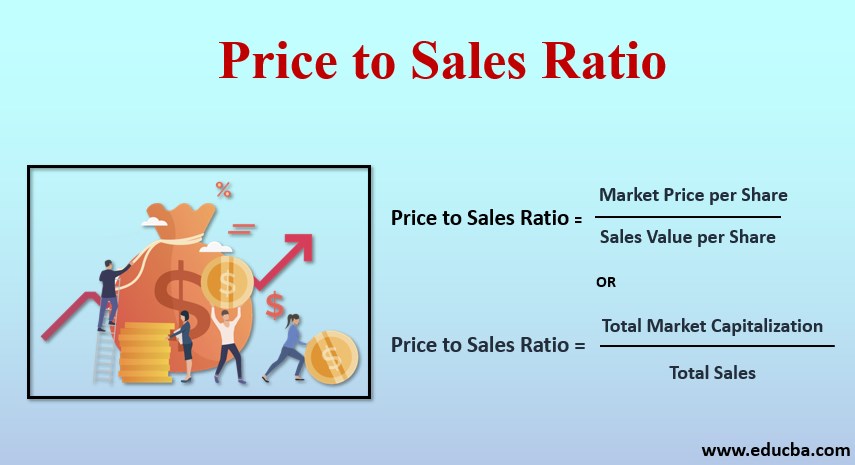

Price To Sales Ratio How To Calculate Price To Sales Ratio Examples

Pin On Contabilidad Y Finanzas

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

Pin By Carmie Mo On Art Tutorials Inspo Net Profit Profit Accounting Training

0 Response to "how to calculate sales introduction to finance"

Post a Comment